If you were wondering why certain video game companies continue to double down on NFTs, the answer has never been clearer. In a recent OpenSea auction, developer Konami recently made US $162,000 ($224,000 AUD) from Castlevania-themed NFTs.

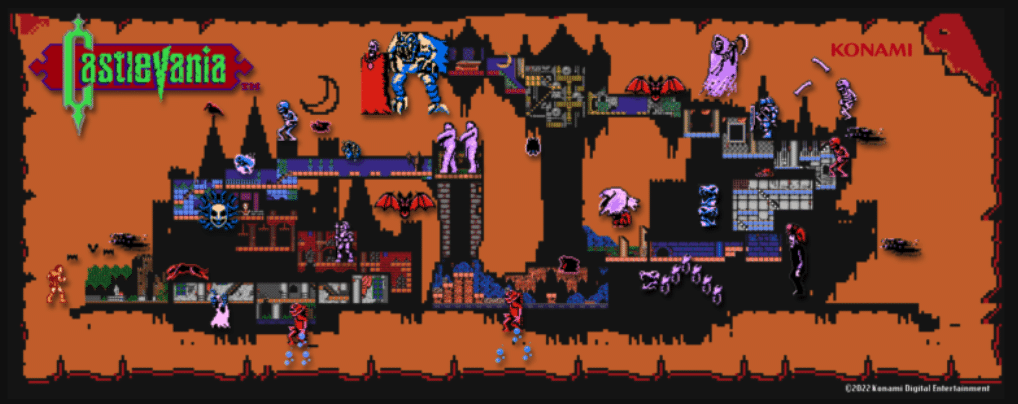

These digital items ranged from a pixel art map of Dracula’s castle to a three-minute video of footage from Castlevania games. After going on sale on January 12, it took less than a single week for the entire collection to sell out, with the average price of each NFT sold being around US $12,000 ($16,639 AUD).

One NFT – the map of Dracula’s castle – sold for US $26,538.96 ($36,798.92 AUD).

As pointed out by VGC, when you take away service costs on OpenSea, the total sales mean Konami walked away with US $175,000 ($242,692.62 AUD) simply by selling digital items that don’t equate to really “owning” any part of the game at all.

The NFTs are simply memorabilia that buyers likely hope will be worth more as a digital collectible in future.

Konami has indicated this Castlevania NFT collection is just the ‘first’ of upcoming projects – and when you see the eye-watering sum these tokens generated, you can understand why that might be the case.

Read: Why are video game companies doubling down on NFTs?

Despite major backlash from users online, concerns about the environmental toll of NFTs, and the lack of real ‘ownership’ backing the blockchain technology, companies are still making small fortunes on their sales.

While it’s not quite ‘free money’, NFTs are relatively low effort creations – and in times of economic downturn, they represent a hope for impacted companies. For buyers, they represent a similar lifeline: an emerging technology that may or may not have the potential to save them from tough financial hardship.

The simple fact is that as long as NFTs continue to be minted, there will be people willing to purchase them, regardless of guarantees towards value. As speculation and enthusiasm around NFTs and their worth continues, there are countless people willing to bet enormous sums of money on the chance that what they spend will eventually grow with time.

It’s no wonder companies are continuing to invest in the technology.

Explore Our Trusted Gambling Resources

Discover essential guides to casino sites, betting platforms, and crypto casinos—updated for 2025.